Author: Francesco Castelli

In this article, we provide an updated estimate for the green bond premium (“greenium”) in the EUR market. We validate the common hypothesis that green bonds tend to trade a tighter spread (lower yield) than comparable “brown” bonds, and we offer some conclusions on green bond investors.

The first green bond was issued in 2008 by the World Bank: a far-sighted initiative, which initially gathered a limited number of followers. In recent years, however, issuance has exploded reaching 257bln USD in 2019 (up 51% vs 2018). Europe is the largest market and last year accounted for 45% of issuance.

The green bond universe includes a variety of different standards and flavours: in most cases, however, the issuer will include in the prospectus a pledge restricting the use of borrowed capital. This money will be generally earmarked to fund specific projects or business lines. For example, an issuer in the power generation sector may use proceeds from green bonds to improve its energy mix (for instance, purchasing wind turbines or solar panels). A real estate company (or a bank) may use its green issuance to fund house developments with green (energy-efficient) buildings. In a few exceptional cases (Enel, Chanel), the borrower commits to a financial penalty if green objectives are not met (paying a higher coupon, or a higher capital reimbursement). In general, however, green bonds returns exactly mirror their brown counterparties: their cashflows rank pari passu with existing, non-green securities. They do not provide any meaningful extra-return to green bond investors.

From an ESG perspective, it should be noted that green bonds are not a synonym of good ESG rating: there are many examples of companies with poor ESG credential accessing the green bond market. Granting green funding to “brown” companies incentivizes their sustainable approach, but may also cross-subsidize more controversial business areas.

Using Bloomberg database, we identified a universe of bond issues classified as “green” and “corporate” (including some government-owned entities): as of September 2020, we found 305 green bonds issued in EUR, with a benchmark size (i.e. an outstanding amount above 500 million).

To estimate the “greenium”, we opted for a straightforward procedure: each green bond was compared with one or more non-green bonds issued by the same issuer, with similar characteristics:

- Same seniority

- Similar maturity (or similar call schedule), with a maximum difference of 1 year

- Similar liquidity (restricting the analysis to benchmark bonds).

- Same currency

Pairing green bonds with brown bonds are not always possible, and we had to drop more than half of our sample: in some cases, the issuers did not offer any bond close enough to justify a comparison with its green bonds. In other cases, the issuer has been systematically switching its issuance strategy towards green bonds and no longer issues brown bonds. Our final sample shrank to 130 bonds: a much smaller but statistically respectable number of data points. The estimation process was straightforward: for each green bond, the premium (in basis points) was defined as the difference between:

- asset swap spread (ask) for green bond

- asset swap spread (ask) for comparable non-green bond

Such a simple procedure does not require any curve fitting (which can be tricky for corporates with a limited number of outstanding bonds). Moreover, the use of the asset swap spread (instead of simple spread to mid-yield) takes into account different coupon levels.

Our estimation covers the period between January and September 2020; it was performed on secondary prices while avoiding primary issuance estimates. While new issue premium is certainly a key variable for borrowers and investors, estimation is somewhat more complicated. It requires additional parameters (to separate green premium from new issue concession).

Our results show a persistent negative premium (“greenium”): on average, over the course of 2020, green bonds have offered spreads 3 basis point (0.03%) lower than “brown bonds”. While this might look insignificant, it represents a 6% “haircut” to the average credit spread offered by any given borrower.

| Average "Greenium" | -1 |

| As a % of spread | - 6% |

| AAA rating | -1.6 |

| AA rating | -0.9 |

| A rating | -3.8 |

| BBB rating | -4.1 |

The “greenium” curve is relatively well behaved: premium tends to increase with lower ratings (in line with higher credit spreads).

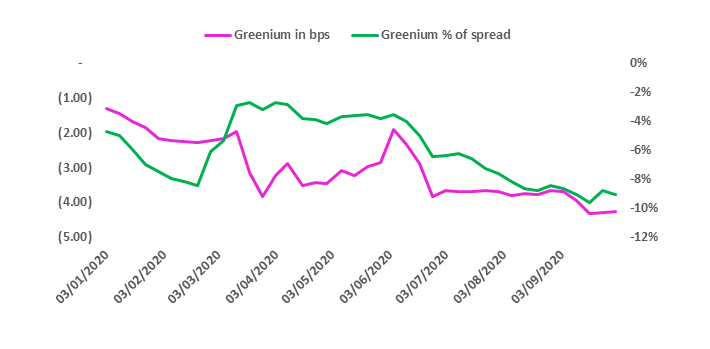

In terms of dynamics, the “greenium” for our sample was relatively low at the beginning of the year (around 1 bps, or 5% of the spread). However, the spread moved wider and wider of the course of the year and was larger than 4 bps (or 10% of total spread) at the end of September.

Conclusions:

The green bond market is expanding at a very healthy pace, and it is becoming the issuing market of choice for several borrowers. The existence of a negative premium for green bonds offers an exciting funding opportunity but suggests some degree of market segmentation in the buy-side: demand for green bonds tends to outstrip supply. It is relatively inelastic to price/spread. Why are green bonds investors systematically buying lower-yielding bonds and systematically accepting a certain degree of underperformance versus non-green investments?

We believe that green bond investors can be characterized by one of the following approaches:

- thematic investing, where the portfolio manager has specific constraints and is incentivized to select green investments (despite their lower expected return)

- impact investing, where investors are ready to sacrifice their returns to generate a meaningful impact on social or environmental issues

The existence of a “greenium” is a challenge for this asset class: a persistent underperformance is challenging to justify, especially in an environment of ultra-low interest rates. In this respect, we note that the current level of “greenium” is somewhat manageable and still makes green bonds attractive to investors that are happy to sacrifice some basis points to take exposure to sustainable investments. On a longer-term perspective, the asset class would undoubtedly benefit from some form of incentive: a favourable tax treatment, for instance, may develop a virtuous circle, where investors are happy to accept lower returns while receiving a tax rebate and supporting a greener economy.

Francesco Castelli is the Head of Fixed Income at Banor Capital and manages the Banor SICAV Euro Bond and Aristea SICAV Enhanced Cash funds.

Francesco Castelli is the Head of Fixed Income at Banor Capital and manages the Banor SICAV Euro Bond and Aristea SICAV Enhanced Cash funds.

This article was written on behalf of CFA UK ESG Working Group.