Eleven years before Lehman Brothers collapsed, David Green was worried that banking supervision needed reform.

In the September 1997 issue of Professional Investor, David Green expressed his concern for the future of the European banking industry. He argued that the impending monetary union of the EU would necessitate the requirement for reform in the sector.

But it was not an area where most industry players were focusing their consideration at the time. As Green himself stated, booming stock prices and rosy market expectations concerning most of Europe’s banks meant it was an odd time to talk about reform. But, he said, there were reasons to be cautious. He warned that banking was a notoriously cyclical business, and that the upcoming monetary union in much of the EU would usher in big changes for the industry, on top of the competitive challenge posed by supermarkets, insurance companies, manufacturers, and others which were entering the space normally occupied by more traditional players.

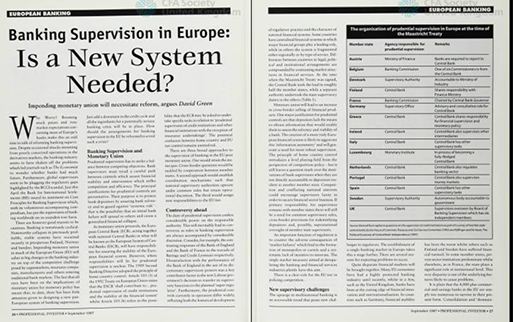

“The fact that all eyes have been on the implications of monetary union for monetary policy has meant that, to date, there has been little attention given to designing a new Pan-European system of banking supervision,” he argued.