Author: John Young

Bitcoin is a financial bubble that is going to burst, says John Young, a financial consultant with 20 years of experience in insurance and banking. Young is currently writing a book on banking called “Money, Mayhem & Madness”.

How much would you invest in something that uses “made up” money to pay people to solve a pointless maths problem? The answer according to Bitcoin investors is $104 billion as of 28th June 2018.

All good asset bubbles start with a combination of scarcity, hype plus eye watering profitability for early adopters. Bubble deflation happens when the hype gives way to economic fundamentals. So far, Bitcoin’s investors have focused on the first three rather than the underlying reality.

Scarcity has been designed into bitcoin. Only 21 million bitcoins will ever exist. This is the digital currency's major "selling point". It promises to create an electronic "gold standard" and a digital form of hard money in a world worried about Quantitative Easing and loose monetary policy.

In terms of hype, Bitcoin transformed the most inefficient element of its design into something more exciting by coining the terminology of Bitcoin “mining”. People hear “mining” and seldom stop to ask what this means, they think of gold or silver and feel it’s OK.

Playing Bingo

In reality, Bitcoin mining is more akin to playing an electronic game of Bingo. Bitcoin’s miners are competing to be the first computer, out of millions, to solve a hugely difficult but totally pointless maths problem. Whoever finds the solution first is “paid” using some newly created Bitcoins, summoned out of the virtual ether. The problems being solved by the army of Bitcoin miners need to be very, very, hard. This, along with the fact there are so many computers trying to solve it is what makes bitcoin secure.

The problem is designed to be solved by trial and error - in layman's terms - guesswork. It has to be hard to do since the valid solution is used to close each new "block" of data and make all the Bitcoin data secure. The problem and solution are linked because ALL the new Bitcoin transactions to be stored in a new block, PLUS the solution of the last problem (which creates a historic chain of correct solutions) are used as inputs to the new problem. This means, if you change a single Bitcoin transaction within any block, you will also change one of the inputs to the associated problem. As a result you will need to solve a whole different problem – which is just as hard as the original. Even if you succeed, this problem will generate a totally different valid output solution. This changes what feeds into the next “block” of data, changing the next solution and so on…

This makes Bitcoin safe because no individual can reliably solve each successive problem faster than all the other computers slaving away. If they could, this would let them re-write Bitcoin's history, on their own, to their own benefit.

Getting so many computers to play pointless guessing games is expensive, but fortunately with Bitcoin, they can currently be paid by creating new Bitcoins out of thin air. At the moment every successful “miner” gets 12.5 bitcoins each time they find a new solution. To ensure that only 21 million Bitcoins are ever created, the number of bitcoins created and given as a reward for each successful guess halves every 4 years.

Bitcoin’s easy trading profits arose when the cost of mining Bitcoins (i.e. the electricity bill for all the computers) was significantly lower that the value of new Bitcoins being given out. Those days are gone. The total running cost for the Bitcoin miners depends on the combined electricity use of the computers involved and the electricity cost per Kwh. Taking the UK's electricity tariff as a reference point, Bitcoin's current electricity cost is $4.7 billion a year. In terms of revenue, at today's price (as of 28th June 2018, 1 Bitcoin = $6,132) the annual mining revenue is only about $4.0 billion. Following the fall in Bitcoin's price, from its peak at the end of 2017, Bitcoin mining is only profitable in countries with cheap electricity.

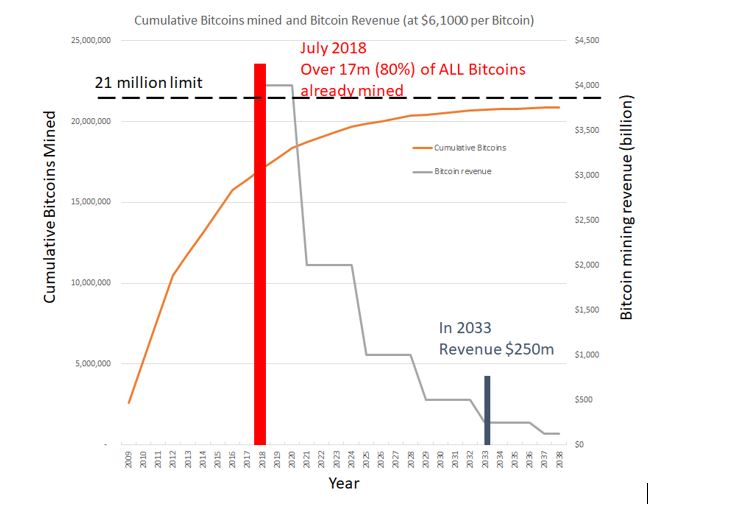

Bitcoin’s scarcity combines with this link between cost and revenue to create a fundamental problem for Bitcoin miners. A cap of 21 million Bitcoins is achieved by halving the number of Bitcoins each time a further 210,000 blocks are mined. This is next projected to happen in May 2020. On this date, the revenue available to Bitcoin “miners” halves. This will keep halving the revenue available to reward Bitcoin miners every four years. In terms of future revenue potential, over 80% of all Bitcoins that can be created already exist. Chart 1 illustrates this problem.

Chart 1. Limiting the number of Bitcoins created limits the income for Bitcoin miners

The numbers are not pretty for Bitcoin speculators. If Bitcoin charged an average of $32.75 per transaction (typical for a UK Bank’s CHAPS payment), the ultimate revenue possible would be about $2.25 billion per annum – or half that of today, even at today's “depressed” price. In contrast, if users decide that they would only pay 18 cents per Bitcoin transaction (typical for a UK debit card transaction), this would imply a long term annual revenue stream of just $13m pa. Hardly the stuff to justify Bitcoin’s $104 billion price tag. The Bitcoin bubble will deflate; how far depends on what users are ultimately prepared to pay to make Bitcoin transactions.

Equally, the technology behind Bitcoin’s hype faces a major problem – it’s insane environmental cost. When all is said and done, Bitcoin, and its associated blockchain technology, are not that efficient. Bitcoin consumes 29TWh (29x1012Wh) of electricity a year to handle around 68 million transactions. For example, RBS (where I used to work) consumes a rather more modest 821GWh (821x109Wh) while handling somewhere in the region of 4 billion transactions a year. (In reality, RBS’s energy consumption, allows it to provide customers with loans, mortgages, credit cards, current accounts, savings accounts etc.) This means, in terms of electricity used per transaction it's about 2,000 times less efficient than a traditional approach - if we assume all of RBS's electricity is used for transactions This wanton destruction of the environment makes Bitcoin a very, very expensive solution. In fact, if we assumed all of RBS's costs just went into making transactions, it would still cost about 20 times less per transaction than Bitcoin.

Like all financial bubbles, Bitcoin’s will burst when investors look and see the underlying reality. The inherent technology limitations mean that Bitcoin is the financial equivalent of rubbing two sticks together to make fire. This technology will only ever be a niche solution where central intermediaries can't be trusted or where privacy of payments is of paramount importance, and inefficiency is a price worth paying.